Capture Oil Price Fluctuations on the Most Popular Trading Platforms

Take advantage of rising and falling oil prices with CFDs from OneRoyal, the globally trusted broker.

Take advantage of rising and falling oil prices with CFDs from OneRoyal, the globally trusted broker.

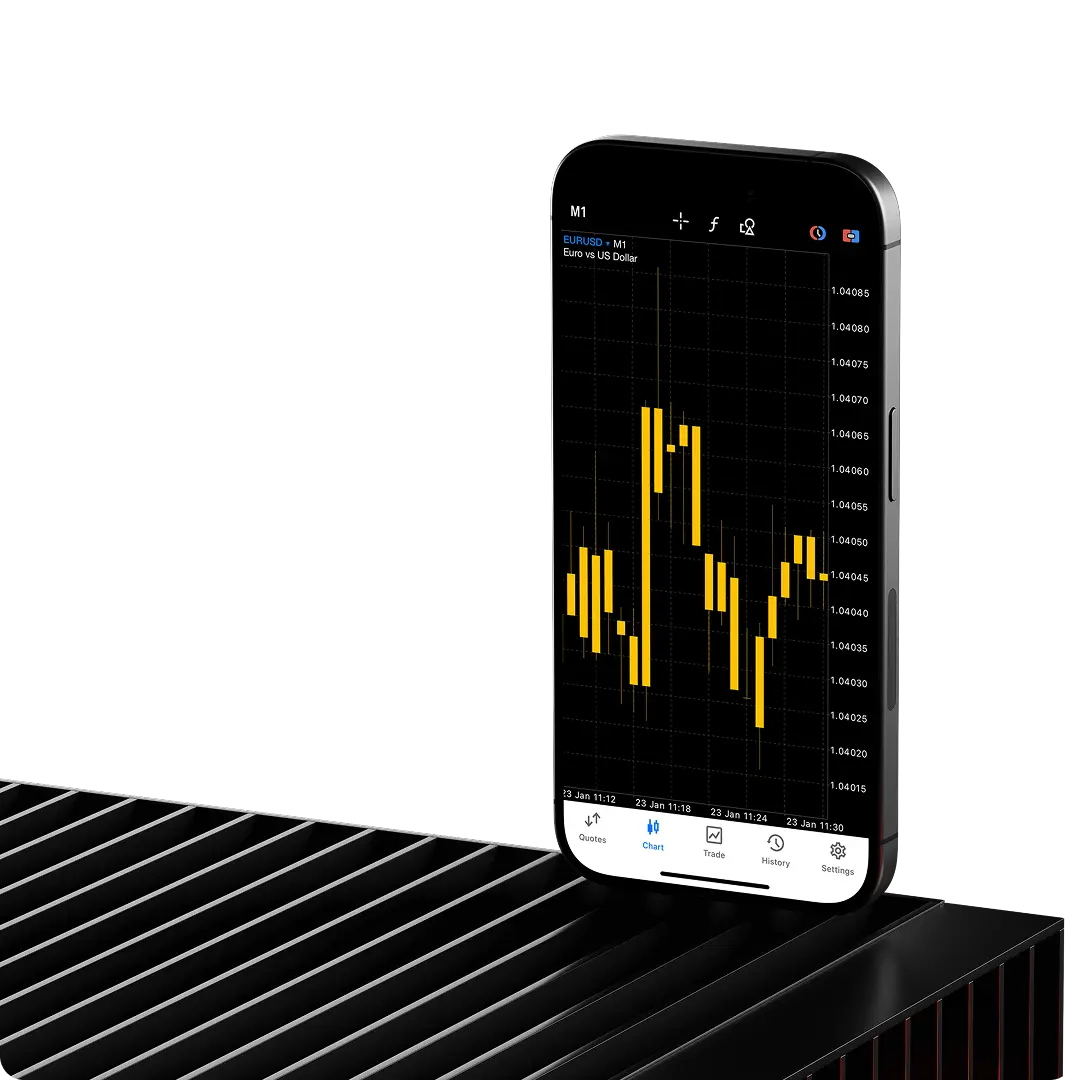

Access the global oil markets and trade fluctuations in the WTI and Brent crude prices on MT4 and MT5 with OneRoyal's oil CFDs.

Established in 2006, OneRoyal has multiple licenses, including from Tier 1 regulators, and offices around the world.

Learn moreBest broker, best online trading platform, best execution provider. We have won numerous awards from agencies worldwide.

Learn moreGet support the way you want. Multi-lingual support, available 24/5 via Live Chat, Email, Phone Call and Messenger.

Learn moreHaving earned the trust of traders, we receive positive reviews and have a strong 4.5/5 ranking on Trustpilot.

Learn more

Trade oil with the best conditions to maximise your trading potential.

| Name | Average Spread (pips) | Spread as low as (pips) | Max Leverage | |

|---|---|---|---|---|

| Average Spread 0.5 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0.4 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0.4 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0.4 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0.5 | Spread Low 0.5 | Max Leverage 1,000 | Trade | |

| Average Spread 0.4 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0.4 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0.5 | Spread Low 0.4 | Max Leverage 1,000 | Trade | |

| Average Spread 0 | Spread Low 0 | Max Leverage 1,000 | Trade | |

| Average Spread 0.4 | Spread Low 0.4 | Max Leverage 1,000 | Trade |

The most popularly traded types of oil are the US and Brent crude oil. US crude oil is known as West Texas Intermediate (WTI) and is characterised as “light” and “sweet” due to its low density and sulphur content. It is the primary oil price benchmark in North America. Brent refers to oil produced in the North Sea and is the pricing benchmark for about 80% of the globally traded crude oil. It is also characterised as “light” and “sweet,” but the oil tends to have higher sulphur content and density.

Oil is the most popularly traded commodity in the world. Oil trading can be done through futures, options, or Contracts for Difference (CFDs). While all three are derivative instruments to speculate on the future price movement in the oil markets, CFDs are perhaps the most popular. This is because you can trade oil without needing to take physical possession of the commodity. Learn more about the oil markets and how to trade the commodity with OneRoyal Academy.

A Contract for Difference (CFD) is an agreement to exchange the difference in price between the opening of the contract and its closing. You don't need to take ownership of the underlying asset to trade CFDs. Plus, CFDs allow you to speculate on both rising and falling oil prices. They give access to the global oil markets and allow you to expand your exposure even with low capital in your trading account through leverage. However, remember that since leverage increases market exposure, it also magnifies potential profits and losses. Risk management is crucial while trading oil via CFDs.

By trading with a regulated broker, you're protected against fraud, unfair practices and illegal activity. Also, regulated brokers comply with strict financial standards, ensuring the security of your money.

Start your journey towards data-driven success by taking advantage of our free trial.