Trade Exchange Traded Funds with OneRoyal

Diversify your portfolio and get instant exposure to the global markets with OneRoyal's ETFs.

Diversify your portfolio and get instant exposure to the global markets with OneRoyal's ETFs.

ETF trading with OneRoyal is a great way to gain exposure to different asset classes, including stocks across multiple sectors, bonds, foreign currencies and/or commodities, with a single trade.

Established in 2006, OneRoyal has multiple licenses, including from Tier 1 regulators, and offices around the world.

Learn moreBest broker, best online trading platform, best execution provider. We have won numerous awards from agencies worldwide.

Learn moreGet support the way you want. Multi-lingual support, available 24/5 via Live Chat, Email, Phone Call and Messenger.

Learn moreHaving earned the trust of traders, we receive positive reviews and have a strong 4.5/5 ranking on Trustpilot.

Learn more

Trade ETFs with the best conditions to maximise your trading potential.

| Name | Average Spread (pips) | Spread as low as (pips) | Max Leverage | |

|---|---|---|---|---|

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade | |

| Average Spread - | Spread Low - | Max Leverage 1,000 | Trade |

An Exchange Traded Fund (ETF) is a type of investment fund that allows investors to buy and sell shares of a company’s stock in a single transaction. ETFs are designed to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. They are typically traded on exchanges and are available to buy and sell on a daily basis. ETFs offer investors a way to diversify their portfolios by investing in a broad range of companies without having to buy individual stocks.

No, any class of assets with a published index and sufficient liquidity for daily trading can be made into an ETF. Stocks, commodities such as gold and oil, currencies and bonds can all be traded via ETFs. ETFs could also either track multiple sectors in one country or provide access to the global markets.

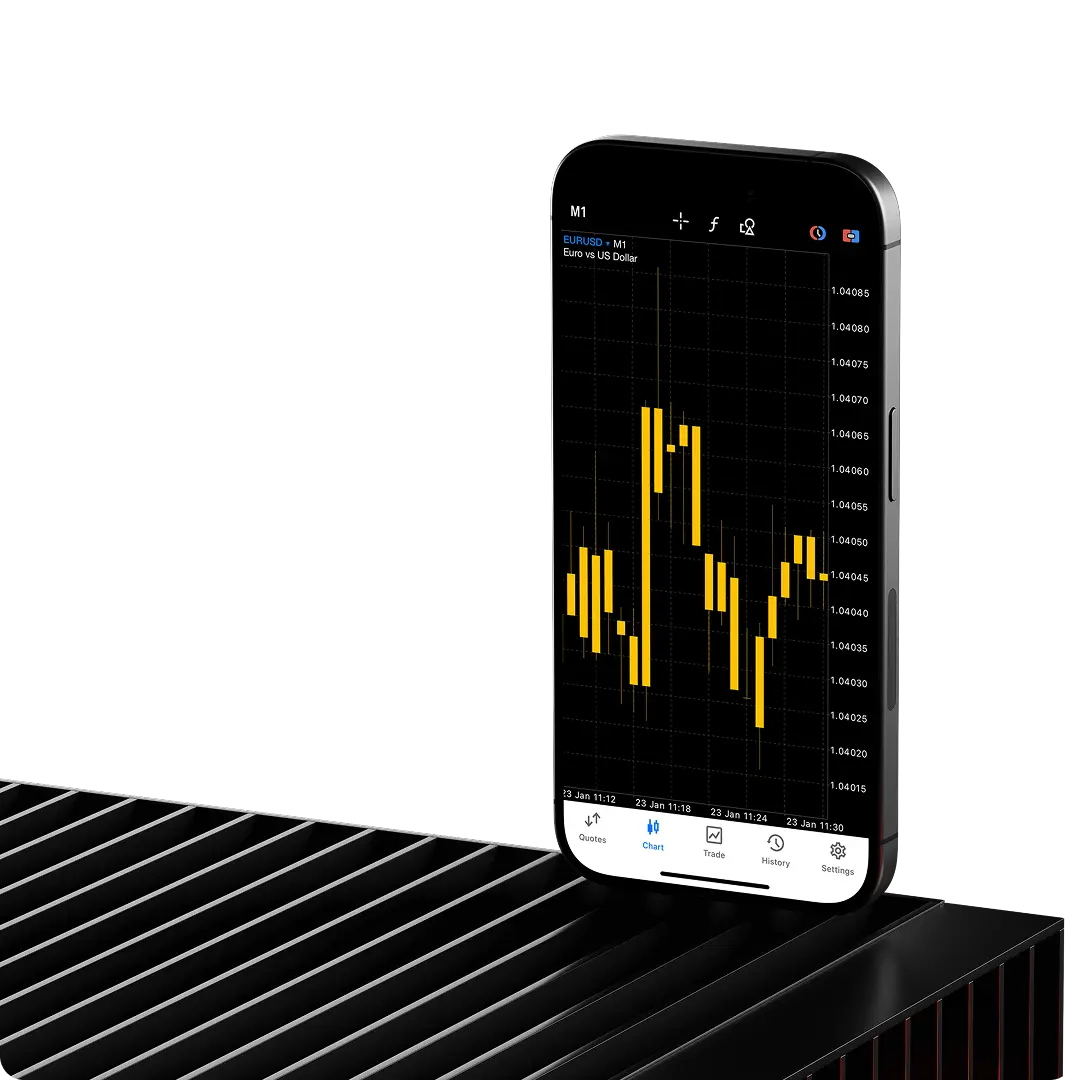

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most popular online ETF trading platforms. They arm you with powerful tools to analyse the markets and trade ETFs from anywhere and at any time.

Yes, they do. You can choose a gold or silver ETF for exposure to spot prices of these precious metals or even an ETF that gives you exposure to say consumer discretionary stocks within the S&P500. Explore the many options by opening an account.

Start your journey towards data-driven success by taking advantage of our free trial.